Bottlenecks, blind spots, and blended finance

Towards a new financing framework for people and nature

The GEC Insights series is a curated collection of online articles at the intersection of environment and economics, each written by a leading thinker from the worlds of business, government and civil society. Part of our Economics for Nature project, they bring together diverse perspectives to answer the question: how can we re-design our economies to protect and restore nature?

In recent years, the finance industry has been making increasing efforts to promote environmental stewardship and consider the impact of economic activity on nature. There has also been considerable progress in identifying and measuring risks of climate change, both in terms of physical risks and transition risks.

Specialist firms are developing tools and techniques and designing new products to stimulate investment in natural capital, such as blue and green bonds. There are funds specialising in renewable energy, facilities for encouraging regenerative systems and circular economies, and specialist service providers to assist in the deployment of this capital. These trends have been spurred by advocacy as well as by legislative and regulatory changes and stakeholder pressure.

For the most part, the green transition is being financed mainly by debt (public and private) with the sources include development finance institutions (DFIs) and bilateral funding. In wealthy countries, there is an increasing amount of private equity coming from infrastructure or specialist funds, with commercial banks also providing some finance. Alternative finance plays a very small role, through venture capital firms supporting climatetech start-ups.

Innovation in the finance sector is central to accelerating the transition to green and inclusive economies, and in navigating a just transition from the status quo. It can enable or impede the large-scale transitions needed to move to an economic system based on sustainable production and consumption, improved stewardship of natural capital (including biodiversity), and more effective innovation across economic sectors.

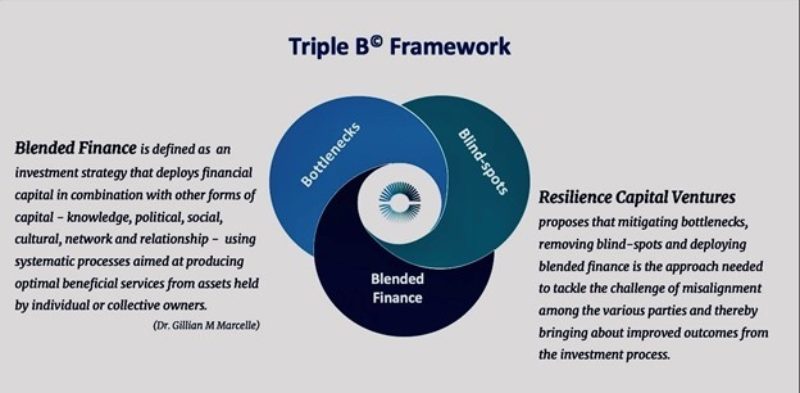

To achieve these objectives, we recommend application of the Triple B Framework, a new approach that addresses sluggishness in capital growth and capital misallocation. This framework draws on Douglas North’s institutional economics emphasizing the role of structures, processes, cultural rules and norms in behaviour and outcomes.

It also builds on the theoretical work of Marcelle in which she argues for reimagining innovation as a knowledge and learning process rather than a technocentric exercise, obsessed with novelty. In this framing of innovation, the positive outcomes for the world arise out of actively seeking solutions in as wide a space as possible.

The Triple B Framework draws on many years of capital markets experience and consolidates the lessons learned from investing in technology-intensive sectors such as telecommunication and renewable energy. Knowledge gained as a practitioner is combined with an explicitly feminist intersectional analysis, as well as a development studies lens which calls for identifying causal factors, intervening actors, pathways and differentiated outcomes.

Unpacking the Triple B Framework

The Triple B conceptual framework consists of three components: bottlenecks, blind spots, and blended finance. Bottlenecks are defined as barriers that hinder capital mobilization and deployment processes, and these are categorized as structural, processual and cognitive.

Blindspots work similarly to bottlenecks, but specifically arise out of human behaviour and attitudes. Drawing on psychology, including work on bias, we argue that blindspots often result in misalignment of capital mobilization systems and have negative effects on human wellbeing. Among the most common cognitive blindspots, is “group-think” arising from homogeneity.

In the finance industry, persistent gendered, racial, and ethnic homogeneity creates major blindspots in decision-making and execution. There is a growing body of evidence about the negative effects of these characteristics on fund performance and on the organizational culture in financial firms. We believe that these blindspots also result in high opportunity costs as finance and investment firms effectively limit their solution space, innovation, and problem-solving capability.

The final component of this framework - Blended Finance - is defined as an investment strategy that deploys financial capital in combination with other forms of capital — knowledge, political, social, cultural, network and relationship — using systematic processes. The investment strategy envisaged by this framework aims to produce an optimal level of beneficial services from assets, recognizing that these may be held either by individual or collective owners.

Moving the money to the right places, and in the right sequence

The Triple B approach and, in particular, its definition of blended finance, can be applied in capital markets and settings around the world, but importantly it takes into account the features of countries where business and capital market ecosystems are weak. It suggests that in those contexts, non-financial forms of capital may even be more important than financial capital.

“ In the finance industry, persistent gendered, racial, and ethnic homogeneity creates major blindspots in decision-making and execution.”

By building upon existing definitions of blended finance and focusing on a variety of forms of capital, the Triple B approach can provide guidance even where capital markets are not mature. This approach to structuring blended capital facilities differs from many of the conventional approaches put forward by the IFC, OECD, WEF, and Convergence, which emphasize the varying types of financial capital normally found in advanced, sophisticated markets.

These are less appropriate for emerging markets, which are not well endowed with the specialists and financial engineering talent needed to design deal structures but are rich in the cultural and social knowledge necessary to activate assets and generate value over time.

The Blended Finance component of the Triple B framework suggests that in emerging ecosystems, catalysts play critical roles and should receive support as a priority. Ecosystem builders help to produce smooth supply responses by deploying non-financial forms of capital, thus helping to align the supply and demand side of capital markets.

Non-financial capital is often required ahead of financial capital injections, and institutional infrastructure often receives the first dollars invested, rather than individual enterprises. Therefore, in addition to identifying champions among individual businesses, we suggest that supporting ecosystem builders is critical.

The framework recommends sequencing financial and other forms of capital to better serve developing countries and recognizes that DFIs can play an important role by providing technical knowledge and other forms of capital necessary to enhance market functioning.

Progress is being made

The Triple B framework challenges the status quo and outlines steps for greater responsiveness and accountability in development finance. When the inputs enshrined in the Framework come early in the lifecycle of investment projects, those actions send important positive signals and work to de-risk investments. For example, development partners can support efforts in emerging markets, such as those underway in Jamaica, to define the green economy and map the sectors and investment level projects associated with this domain.

The Caribbean region has seen recent successes in crowding-in private sector capital including from domestic financial institutions when the MPC Caribbean Clean Energy Fund used a dual listing on the Trinidad and Tobago and Jamaican stock exchanges to mobilize investment funds.

Armed with an in-depth understanding of the sources of capital in the region, Resilience Capital Ventures was able to assist with mobilizing financial capital from credit unions securing investments for the private equity fund.

Innovative financing in other parts of the world has shown that considerable time and effort is required to experiment, review, and fine-tune the design of financial products and facilities. It is this type of non-financial capital that is urgently required to activate underperforming resources and assets.

Expanding vision for a new finance professionals

The Triple B Framework is also useful in advanced markets and its perspectives are beginning to show up as financial firms embrace the value of diversity of subject area knowledge. The regulatory and policy environment in advanced capital markets is changing to better integrate Environmental, Social and Governance (ESG) issues, and there are many industry factors supporting change and better articulation of the business case for the ESG subsystem.

These responses see financial services companies moving to improve their corporate structures and incentives so that they can attract talent. The combination of these effects improve the ability to secure benefits from natural capital.

While specialisation is more established in the global North, there are pioneers in other parts of the world. An example of a business actively operating to support a just transition is Igugu Global Limited, an environmental risk engine that allows for the repricing of financial assets to take account of climate risk. It is directed at understanding risk from a global South perspective and has begun to gain traction across the African continent.

Capacity building is an essential component of restructuring capital markets to respond to the climate and biodiversity crises. In the Triple B Framework, investment programs should be designed to include training, workforce development, knowledge search, scan and sharing systems and personal development. These are viewed as central components of an investment strategy and not mere add-ons.

Learning and capability interventions designed to address weaknesses in the financial system and at the same time work to attract greater investment. These capability building efforts benefit from collaborative networks and new channels of communication across siloed sectors. This allows for better alignment on connecting the languages, priorities, and interventions across sectors.

The Triple B framework outlines strategies for activating assets and benefiting society. Using this approach involves removing bottlenecks and blind spots that get in the way of flourishing economies and societies, by mobilising diverse sources of capital, including knowledge, political and social capital. The framework works best when woven together by tissues of collaborative and action-oriented networks. We are confident that this approach will make a positive contribution to the just transition agenda.

- Dr Gillian Marcelle, leads Resilience Capital Ventures LLC, a boutique capital advisory practice specialising in blended finance. She has a proven track record in attracting investment to emerging markets. As part of her thought leadership practice, she is very active in the impact investment space, where her contributions and perspectives on diversity, inclusion, accountability, and alignment with the SDGs are becoming influential.