Over the hill or a spring in their step?

The World Bank and International Monetary Fund celebrated their 80th birthdays this year. Are they still up to the job?

Last month the International Monetary Fund and the World Bank held their annual spring meetings in Washington DC, celebrating 80 years since their creation at the 1944 Bretton Woods Conference. The meetings brought together heavy hitters from the worlds of policy, finance, central banking, and investment.

Outside the heady horse-trading of Washington DC, the world continued its slow-motion stumble towards institutional rot, populist revolt and an unliveable atmosphere. The World Bank gestured towards climate investment while continuing to pump money into coal, oil and gas; indeed it emerged that the Bank had categorised loans for the construction of luxury hotels in Senegal as “climate finance”.

Even within the seminars and conference rooms of the Spring Meetings, the conversations seemed unusually incoherent. One seasoned observer noted that the mood was “fundamentally more uncertain than at any time during the 40 years I have come to IMF annual and spring meetings”.

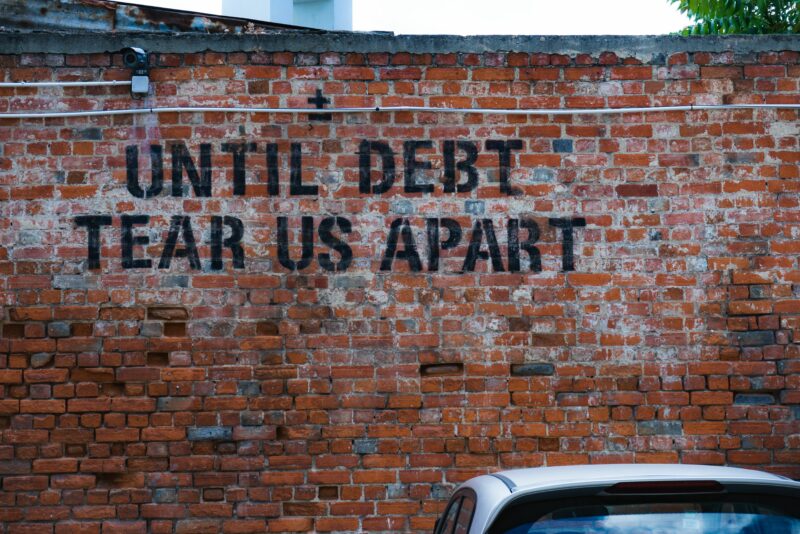

“ Poor countries are now paying more to rich ones in interest repayments than they are receiving in aid.”

The landscape of global economic policy is rapidly deteriorating, as the war in Ukraine and US-China rivalry pushes national security concerns to the fore and erodes thirty years of multilateralism. Geopolitics now trumps economics, and with international relations unravelling at frightening speed, governments are struggling to cope with the multiple shocks of recent years. Chaos is the new normal.

Meanwhile, back at the Bank

So, given these relatively dire straights, what did the Spring Meetings achieve? Let’s take a look at the headline accomplishments.

The World Bank launched the ambitiously-titled “Global Solutions Accelerator Platform”, comprising a group of 11 rich countries putting in an additional $1 billion each for development loans – amounting to about 0.0025% of their combined total GDP. Old hands judged that this was a signal that the Bank is serious about implementing its Evolution Roadmap – but it’s important to remember that the ODI has judged that Roadmap itself is still “nowhere near sufficient” to achieve global development and sustainability goals.

The Bank’s President also used the Spring Meetings to announce a range of procedural improvements to the Banks operating regulations and internal bureaucracy. These reforms aim to speed up loan approval process and improve accountability, and could, potentially, lead to improvements in efficiency within the Bank’s lending to embattled and chronically indebted low-income countries.

Efficiency gains might somehow not quite be enough, especially since the Bank’s own data shows that in 2023 the net financial flows from rich countries to poor actually reversed. This means that poor countries – which are already suffering the worst impacts of climate change, and will continue to do so – are now paying more to rich ones in interest repayments than they are receiving in aid.

But at least the Bank told us what they’re doing – unlike the G20 Finance Ministers & Central Bank Governors, who declined to give any summary at all of what they discussed during their high-level meeting. This is odd, to say the least – even during the most challenging days of the early Ukraine war, a summary of topics discussed was published even if no consensus was reached.

Over at the IMF, the main news was that the Fund’s current Managing Director, Kristalina Georgieva, had managed to secure a second term, over the objections of many in both the United States and low-income countries around the world. Oxfam International called out the Fund for “clinging to the past and the archaic ‘gentleman’s agreement’ that keeps a European at its helm”, and the Bretton Woods Project dismissed IMF reform efforts as “continuing to sleepwalk through crises.”

Pipe dreams

Of course, like any NGO we have a wishlist of what we’d have liked to have seen from the Spring Meetings: a quantum leap forward in financing to low income countries and those most vulnerable to climate impacts; a radical programme of debt restructuring that could relieve the massive pressure on poorer nations imposed by escalating loan repayments; new and binding commitments to tax obscene wealth, cut fossil fuel subsidies, and redirect oil & gas wealth into ambitious decarbonisation programmes.

That none of this was achieved is unsurprising. Since the 2008 global financial crisis, the world has weathered an accelerating series of global shocks – everything from major bank defaults to a literal plague, with several commodities crises, major invasions and the odd genocide thrown in.

The end result is that the economists and policy wonks who make up the Bretton Woods institutions find themselves in a strange new world, off the charts and without a map. At the Spring Meetings, “nobody even pretended to know what the future will look like” anymore; they’re just as confused and uncertain as the rest of us. If we expect large and entrenched bureaucracies to suddenly embrace radical and sweeping change during a time of unprecedented uncertainty, then perhaps we are the ones being unrealistic.

Putting out to pasture

To be fair, not many octogenarians are as sprightly as they once were, and as these leviathans of international finance enter their eighth decade, it seems sclerosis, hearing loss, and dementia may be setting in. The lack of outcomes from the Spring Meetings simply underline, in Eurodad’s words, “just how outdated and ill-equipped these institutions are, making them unable to address the complex realities of the 21st century… Instead of addressing their structural problems, they have reaffirmed the same failed recipes.”

The theme of the 2024 Spring Meetings was “From Vision to Impact”. The vision is of more of the same – more markets, more commodities, more money, more business as the usual. The impact, on current trends, seems to be the breakdown of the 20th century international system of which the IMF and World Bank were born.

- Ben Martin, Green Economy Coalition